By: Sam Valouch | VP, Loan Transfers & Consumer Loans | Date: July 10th, 2025

When I first entered the mortgage servicing industry, I had no expectation that it would become the foundation of my professional career. What began as a temporary position in Document Control has evolved into a nine-year journey encompassing six promotions and specialized leadership in Home Equity Line of Credit mortgage servicing operations.

This progression has taught me that the mortgage servicing industry reveals its depth gradually. What initially appears to be documentation and compliance processing unfolds into appreciation for the intricate systems that support homeowners’ most significant financial commitments. My experience reflects not only personal growth but also the sophisticated expertise required to excel in today’s complex mortgage subservicing environment.

Navigating the Complexity of HELOCs

Through my specialization in HELOCs, I have come to appreciate that these products represent one of the most operationally complex offerings in residential lending. Unlike traditional mortgage loans with fixed payment structures, HELOCs function as dynamic financial instruments that I have learned to navigate through several key characteristics.

These products transition through distinct periods with draw phases that have interest only payments followed by repayment phases with principal and interest requirements.

In my daily operations, I manage HELOCs that typically feature variable interest rates tied to market indices, requiring sophisticated calculation engines and proactive borrower communication protocols.

My responsibilities include real time monitoring of available credit, overlimit conditions, and access restrictions based on property values and borrower qualifications.

I ensure HELOC servicing adheres to multiple regulatory frameworks, including Truth in Lending Act provisions specific to open end credit products.

This complexity creates both challenges and opportunities that have shaped my commitment to operational excellence.

Analytical Problem-Solving in HELOC Servicing

My professional growth in HELOC servicing has required more than procedural knowledge. It has demanded analytical thinking and proactive risk management. Several experiences have particularly shaped my approach to this complex field.

For example, when I encountered a borrower who had experienced checkbook theft, my response required immediate account security measures while maintaining clear communication about protection steps and account restoration processes. In another instance, during a loan portfolio transfer I was managing, I identified and corrected interest calculation discrepancies that required detailed analysis of calendar logic systems and coordination of comprehensive remediation efforts.

These scenarios have reinforced my understanding that effective HELOC mortgage servicing extends beyond transaction processing to encompass risk mitigation, accuracy assurance, and borrower advocacy.

Strategic Team Development

I believe sustainable service excellence requires systematic knowledge transfer and team development. My approach to training emphasizes foundational understanding rather than rote procedure memorization, focusing on critical knowledge areas.

These areas include freeze condition protocols and triggering mechanisms, overlimit management and borrower notification requirements, repayment structure transitions and calculation methodologies, and promotional rate compliance and conversion processes.

This educational framework ensures that team members I work with understand not only what to do but why specific protocols exist, enabling confident decision-making in complex situations. One of my most rewarding professional experiences continues to be watching colleagues solve complex issues using concepts from our training sessions.

Strategic Partnerships in Specialized Mortgage Subservicing

In my role at Midwest Loan Services, I have developed an appreciation for collaborative partnerships with credit unions and community banks. These relationships require my deep understanding of each institution’s operational philosophy, regulatory environment, and member service standards. As a specialized subservicer, our role extends beyond traditional vendor relationships to become true strategic partners.

I support diverse HELOC configurations, including fixed rate conversion options during draw periods, promotional rate offerings with specific compliance requirements, ACH based payment incentive programs, and customized communication protocols aligned with institutional branding.

My partnership approach ensures that mortgage subservicing operations function as seamless extensions of client institutions rather than separate vendor.

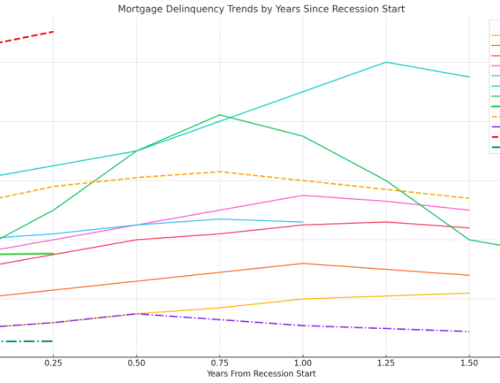

Adapting HELOC Operations for Evolving Market Demands

I observe that current market conditions are driving increased interest in HELOC products. With refinancing activity constrained by elevated interest rates, homeowners are increasingly utilizing home equity lines of credit for financial flexibility. Simultaneously, lenders are developing more sophisticated product features to meet evolving consumer needs.

At Midwest Loan Services, I am actively involved in positioning our organization ahead of these trends through several strategic initiatives.

These initiatives include infrastructure enhancements to support complex product configurations, logic system refinements for advanced borrower incentive programs, operational oversight improvements for multi faceted product offerings, and strategic planning initiatives that anticipate future market developments.

Personal Commitment to Customer-Centered HELOC Servicing

My professional approach to HELOC servicing requires balancing technical precision with recognition of the human element inherent in every transaction. I am constantly aware that each account represents a family’s financial strategy, whether funding home improvements, consolidating debt, or managing unexpected expenses.

This perspective drives my commitment to accuracy, transparency, and responsive service. My parents, like many homeowners, have a HELOC, which reinforces my personal understanding that behind every rate adjustment notification, credit line modification, or access restriction is someone making important financial decisions for their family’s future.

Commitment to Client Partners and Borrowers

Through my experience at Midwest Loan Services, I have found a workplace culture that aligns with my professional standards. We are disciplined, responsive, and committed to borrower-first thinking. This alignment has enabled me to contribute meaningfully to the evolution of our mortgage servicing model, particularly in high-impact areas such as freeze logic, oversight reporting, and draw processing.

I believe that servicing HELOCs effectively requires more than meeting regulatory thresholds. It calls for continuous refinement, cross-functional collaboration, and a mindset that values the borrower’s perspective at every touchpoint. Every billing cycle, system trigger, and communication impacts the overall experience, and I treat each of those moments with the care and attention they deserve.

My commitment remains grounded in the understanding that excellent HELOC servicing requires rigor, clarity, and compassion. While it is not always easy, I believe it is always worth doing right, and I’m proud to contribute to a culture at Midwest Loan Services that takes this commitment seriously and delivers on it daily.